Compliance of Motor Vehicle Dealers – RAHN CASE STUDY ISSUE NO.13-2022

Driving Anti-Money Laundering (AML) risks into compliance – A study on compliance of Motor Vehicle Dealers

Rahn Consolidated (Pty) Ltd’s (“Rahn Consolidated”) articles and case studies are aimed at socialising, climatising, creating awareness and cautioning economic participants on regarding economic crime schemes. The focus will inter alia be on the investigations around compliance of Motor Vehicle Dealers, risks, reporting and most importantly, its regulatory compliance. The term “Economic crime schemes” are often used interchangeably with “Financial Crime”.

For the purpose of ensuring all readers are kept in the loop, Rahn Consolidated will make use of both terms. Rahn Consolidated being at the forefront of deterring Financial Crime through compliance will focus primarily on the compliance of regarding Financial Crime and ensuring fines by way of administrative sanctions that fines are mitigated as much as possible.

Issue No.13 shifts its interest into the motor vehicles dealers industry. This industry is very cash intensive and could easily be susceptible to Money Laundering.

South Africa has specifically applied reporting obligations on dealers in motor vehicles (MVDs), as they are subject to a general reporting requirement, but are not classified as Accountable Institutions (AI) under the Financial Intelligence Centre Act, but rather Reporting Institutions (RI).

This issue particularly highlights risks affecting motor vehicle dealers when it comes to money laundering.

Enjoy the Read!

Item 13 of Schedule 3 of the Financial Intelligence Centre (FIC) Act identifies a person who carries on the business of dealing in motor vehicles as a Reporting Institution (RI).

The Financial Action Task Force (FATF) Mutual Evaluation noted some vulnerabilities or channels that could be exploited to launder proceeds of domestic crime, in particular for the use of cash, while motor vehicle dealers’ understanding of more sophisticated Money Laundering (ML) schemes is limited. During onsite inspections, authorities indicated that they believe the proceeds that stay within South Africa are mainly used to support luxurious lifestyles, including purchasing real estate, motor vehicles etc.

It is important that motor vehicle dealers embed controls in their businesses to ensure that they are not used as vehicles to launder money. Similarly, the authorities noted that motor vehicles were often involved in known ML cases, but such knowledge does not seem inform understanding of sector vulnerabilities.

There therefore seems to be more work that needs to be conducted in this regard. The recovery of cash proceeds of crime remains challenging. Authorities acknowledged that many offenders quickly convert their illicit proceeds to cash, which then becomes extremely difficult to trace. Cash is used by the criminal fraternity to maintain a lavish lifestyle for themselves and their immediate families and is spent on luxury items, such as jewelry, high value motor vehicles and property.

FATF Mutual Evaluation Report_October 2021

Activities to consider in the motor vehicle industry are:

- Motor vehicle related services; and

- Buying and selling of motor vehicle parts.

Now that we know that the FATF takes the motor vehicle industry seriously, we expect these principles to be used to legislate in order to address the risks pertaining to ML within this industry. Having said that, let us unpack the Motor Vehicle Industry from a legislative perspective with particular reference to the FIC Act.

- The Financial Intelligence Centre (FIC) views a “person who carries on the business of dealing in motor vehicles” to be any person who is engaged in the business of buying, selling or exchanging any new or second hand self-propelled vehicle, including a vehicle having pedals and an engine, or an electric motor as an integral part thereof or attached thereto and which is designated to be propelled by these means on land, as well as any trailer and caravan.

- Motor vehicle dealers have a duty to register with the FIC in terms of section 43B of the FIC Act.

- Motor vehicle dealers are required to report cash transactions above the prescribed threshold in terms of section 28 of the FIC Act.

ML/TPF Risks Case Notes: Motor Vehicle dealers

Example of Motor Vehicle Dealers registration

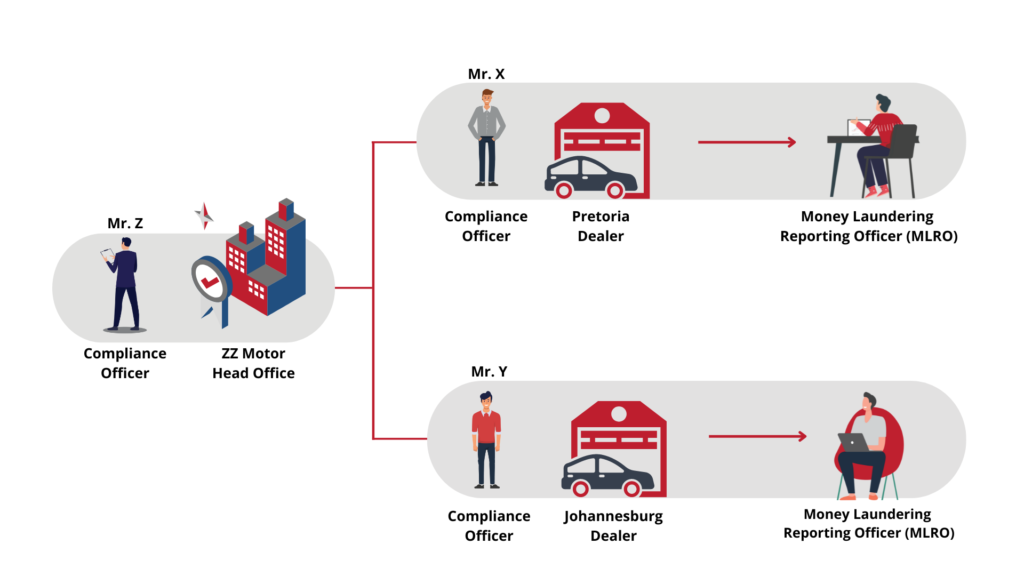

It is important to note that the head office and branches are separate reporting institutions and must be registered separately by the reporting officer responsible for the head office or branch. This also applies to franchises. The registration platform also allows for an instance where one reporting officer is appointed for all branches.

A motor vehicle dealer has one head office and three branches in South Africa. Mr Z is the reporting officer responsible for the head office and all three branches. Only Mr Z can register the head office and branches and only Mr Z will have access to the registration and reporting information. It is furthermore important to note that reporting to the Centre

follows the registration structure of the reporting institution. Multiple Money Laundering Reporting Officers (MLROs) can be added per registration structure i.e. per head office and per branch. If the MLRO is registered at branch level, he/she can only see reporting information of that particular branch.

Example of Motor Vehicle registration franchise e.g ZZ Motors (Fictitious name)