Accountable Institutions – RAHN CASE STUDY ISSUE NO.3-2022

Financial Crimes Governance Documents

Duties of each Accountable and Reportable Institution

The aim of the Rahn Consolidated articles and case studies is to socialise and acclimatise economic participants to economic crime schemes. The focus will inter alia be on the investigations around economic crime schemes, accountable institutions, reporting and most importantly its regulatory compliance. The term, economic crime schemes, is often used interchangeably with Financial Crime, and for the purpose of this article, both terms will be used interchangeably.

Rahn Consolidated, being at the forefront of deterring Financial Crime through compliance, will focus primarily on compliance with Financial Crime legislation thus ensuring fines by way of administrative sanctions are mitigated as much as possible.

Issue No.3 assists all Accountable Institutions (AIs) and Reporting Institutions (RIs) to familiarise themselves with duties and requirements as far as Anti-Money Laundering and Counter Terrorist and Proliferation Financing (AML and CTPF) are concerned. The Financial Intelligence Centre Act (FIC Act) as one of the core regulations in AML and CTPF will be referred to in line with the governance documents that govern these requirements in each business.

Enjoy the read!!

Schedules 1 and 3 of the FIC Act stipulate in a nutshell all businesses (referred to as AIs and RIs) that need to adhere to AML and CTPF requirements. Amongst others business that needs to comply are:

Accountable Institutions (AIs):

- Legal practitioners as defined in the Attorneys Act;

- Board of executors or a trust company as contemplated in the Trust Property Control Act;

- Estate agents as defined in Estate Agency Affairs Act;

- Authorised user exchange as defined in the Securities Service Act;

- Collective Investment Schemes (CIS) Manager as defined in the CIS Act;

- Business of a Bank as defined by the Banks Act;

- A Mutual Bank as defined by the Mutual Bank Act;

- Long-term insurance business as contemplated in the Long-term Insurance Act;

- Gambling activities as contemplated in section 3 of the National Gambling Act;

- Foreign exchange business;

- Business of lending money against the security of securities;

- Business of a Financial Service Provider (FSP) requiring authorisation by FAIS;

- A person who issues travelers’ cheques;

- Postbank as referred to in the Postal Services Act;

- Ithala developmental finance corporation limited; and

- A person carrying out the business of a money remitter.

Accountable Institutions should register as a minimum requirement.

All accountable institutions mentioned above should as a baseline register with FIC as accountable institutions, then internally develop a (1)Risk Management and Compliance Programme (RMCP) which outlines minimum control measures that the AI will take in mitigating AML and CTPF risks. All sections of the FIC Act including those reporting to the FIC should be adhered to by all AIs. Failure of which will result in penalties or fines that were previously alluded to in issue no.2 of Rahn Consolidated’s articles and case studies.

Some of the requirements that are outlined in the FIC Act, which will be deep-dived in the next issues of Rahn Consolidated articles and case studies, are those of identifying and verifying the clients with which the business is dealing.

Rahn Consolidated has realised that many businesses are not aware of their compliance requirement. As a result, some have taken a back seat as the notion has been that of only FSPs being required to comply.

The FIC is also very much aware of this and has as a result provided some guidelines and extended exemptions (which were subsequently changed after the FIC amendment Act-refer to Rahn’s Consolidated’s FCC Q/A publications).

An example of AIs which may not be aware: A Client of an Estate Agent is the person who would provide the agent with a mandate, such a client would need to be identified and verified. An Estate Agent as an AI would also need to have a developed RMCP indicating measures on how FIC Act is adhered to. AML risks pertaining to this type of business still involve cash as there are transactions that take place during the sale or purchase of the property.

In such an example, Rahn Consolidated also provides compliance requirements to assist in verifying client identity as part of due diligence.

(1)An RMCP as contemplated in section 42 of the FIC Act is a principles-based document that highlights all FIC requirements to be adhered to. All AIs need to develop, document, maintain and implement this document as a 1st step to being compliant.

Financial Crimes Governance Documents

Duties of each Accountable Institution (AIs) and Reporting Institution (RIs)

Although AIs are seen as primarily the main businesses which should comply with AML and CTPF regulations including FIC Act. There are certain businesses in which the FIC Act requires compliance from mainly a reporting perspective. This implies that measures in these institutions that need to be put in place are not as stringent as those required for Accountable Institutions. These are referred to as Reporting Institutions. These are Institutions that are required to mainly conduct reporting to the FIC at a bare minimum.

Rahn Consolidated has realised that many businesses are not aware of their compliance requirement. As a result, some have taken a back seat as the notion has been that of only FSPs being required to comply.

Reporting Institutions as contemplated in schedule 3 of the FIC Act include these Reporting institutions.

- Motor vehicle dealer; and

- Kruger Rands dealer.

As part of Rahn Consolidated’s mandate, assisting AIs and RIs to comply by providing tools and technical systems assures both the FIC and the industry to identify the risks around AML and CTPF and to also assist in deterring and mitigating them as a form of risk response.

Example of motor vehicle dealer: BBC Motors (fictitious name-example purposes) which “deals” (buys and sells) both new and second-hand vehicles are expected to register with FIC as a reporting institution and not an accountable institution.

BBC Motors is therefore required to report all cash transactions which come to the dealership that exceeds (24 999.99, to be increased to 49 999.99). These include also buying and selling motor vehicle parts.

Furthermore, should the dealer see any unusual or suspicious transaction or activity within the dealership, these should be reported to the FIC as suspicious activity or transaction reporting.

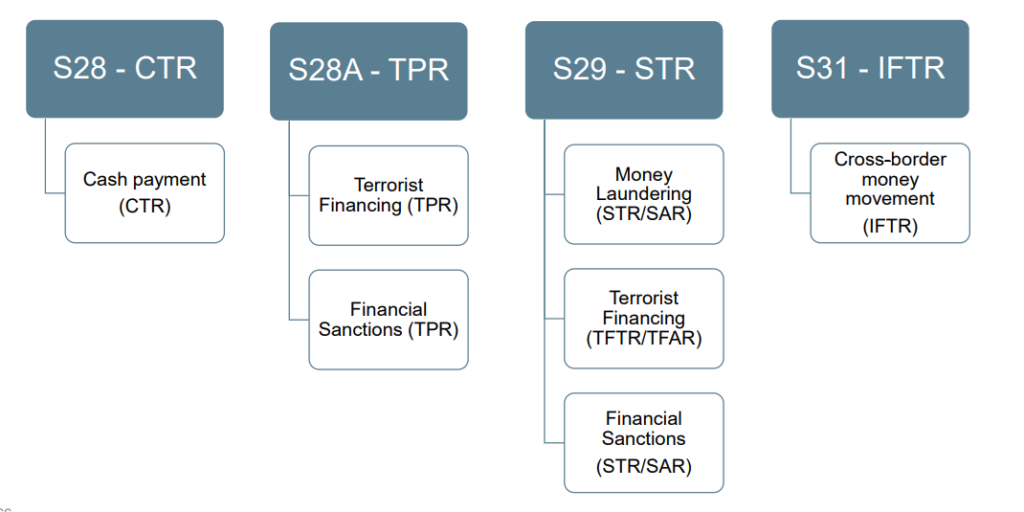

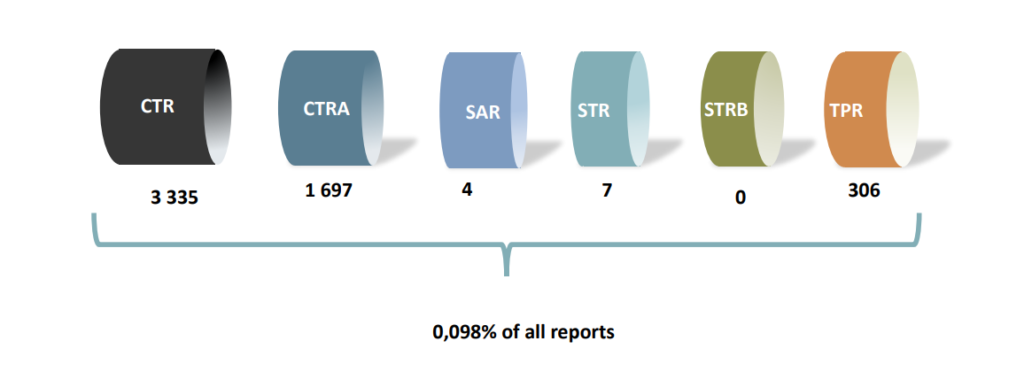

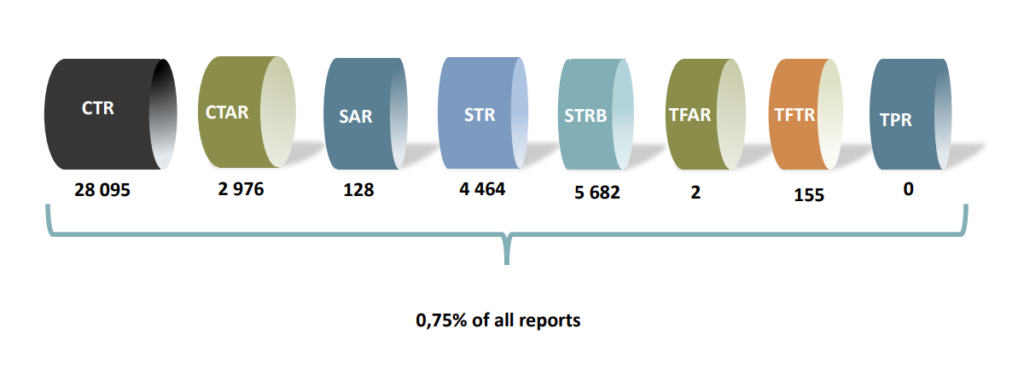

Businesses (AIs and RIs need to bear in mind that the FIC can only deem them compliant if they register with the FIC. This is the 1st point of being compliant. The FIC can only keep track of compliance and assist in deterring financial crime if all AIs and RIs register and comply. Based on examples provided in this issue. The below case study depicts the number of reports that were provided by estate agents and vehicle dealers. This relates to different reporting requirements as contemplated in the FIC Act:

Reporting conducted by Estate Agents:

Reporting conducted by Motor Vehicles Dealers:

Risk Management and Compliance Programme:

Source: FIC Roadshow slides