Collective Investment Scheme – RAHN CASE STUDY ISSUE NO.8-2022

Curbing Money Laundering (ML) in the Collective Investment Scheme (CIS- Unit Trusts) Space

Rahn Consolidated (Pty) Ltd’s (“Rahn Consolidated”) articles and case studies are aimed at socialising, climatising, creating awareness and cautioning economic participants on regarding economic crime schemes. The focus will inter alia be on the investigations around collective investement scheme risks, reporting and most importantly, its regulatory compliance. The term “Economic crime schemes” are often used interchangeably with “Financial Crime”. For the purpose of ensuring all readers are kept in the loop, Rahn Consolidated will make use of both terms. Rahn Consolidated being at the forefront of deterring Financial Crime through compliance will focus primarily on the compliance of regarding Financial Crime and ensuring fines by way of administrative sanctions that fines are mitigated as much as possible.

Issue No.8 focuses on a particular product/business service which is perceived in the industry to be the most vulnerable to ML and being susceptible to be used for ML due to the product features within this particular product/business service.

In this issue, Rahn Consolidated’s approach in this regard is to draw the reader’s attention to different nuances of the Collective Investment Scheme product/business service particularly relating to possible ML. Furthermore, this article will assist businesses in the Collective Investment Scheme space to ensure that they have mitigating controls customised to the business to ensure that ML risks are mitigated.

Enjoy the Read!

Item 5 of Schedule 1 of the Financial Intelligence Centre (FIC) Act mentions a Manager registered in terms of the Collective Investment Scheme Act as an Accountable Institution (AI).

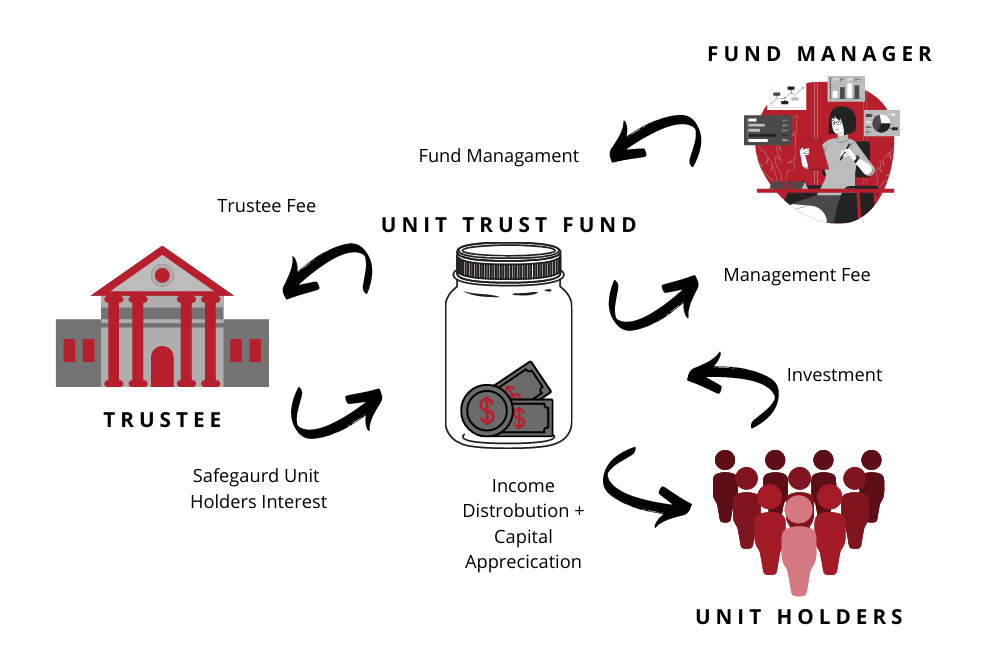

Collective Investments Scheme (“CIS”) is often used interchangeably in the industry with Unit Trust. In essence, a Unit Trust as a product is a form of a CIS which ideally operates by pooling money from individual investors for purposes of investing in various portfolios. Schedule 1 as said above focuses on the Managers registered for these CISs.

Understanding CIS and its Managers

Being a Manager of a CIS implies that you are a person that is mandated in terms of the CIS Act to administer a CIS. By definition in accordance to the CIS Act this regulates an open ended platform which allows members to invest money or other assets in a portfolio. The manner in which a CIS is set up includes scenarios where:

- Two or more investors contribute money or other assets to and hold a 35% participatory interest in a portfolio of the scheme through shares, units or any other form of participatory interest; and

- The investors share the risk and the benefit of investment in proportion to their participatory interest.

From a ML perspective, this implies that there are quite a number of role players in the CIS space who need to be subject to Customer Due Diligence (CDD) . It is pertinent to identify the direct client with whom you are entering into a business relationship.

Managers who administer the Collective Investment Scheme administer by means of:

- Managing or controlling CIS;

- The receipt, payment or investment of money or other assets including income in respect of CIS;

- The sale, repurchase, issue or cancellation of a participatory interest in a CIS and the giving of advice or disclosure of information on any of those matters to investors or potential investors; and

- The buying and selling of assets or the handing over thereof to a trustee or custodian for safe custody.

From the above mentioned administrative duties of Mangers of CISs, we can conclude that all these AIs are interrelated and therefore have similar FIC requirements.

From a compliance perspective, Section 2(1) of the CIS Act requires managers to administer CIS honestly and fairly, with skill, care and diligence and in the interest of investors and the CIS industry.

Section 4(4)(a) of the CIS Act imposes a positive duty on managers to organise and control a collective investment scheme in a responsible manner.

As an AI, the Manager of a CIS is not limited to only reporting obligations but should at a minimum comply with the following:

- Register a business as an AI with the FIC in order to ensure regulatory reporting through go-AML;

- Develop a Risk Management and Compliance Program (RMCP);

- Conduct Customer Due Diligence (CDD);

- Develop a compliance framework and appoint a compliance officer;

- Conduct training on AML/CTPF risks and controls;

- Effectively keep records; and

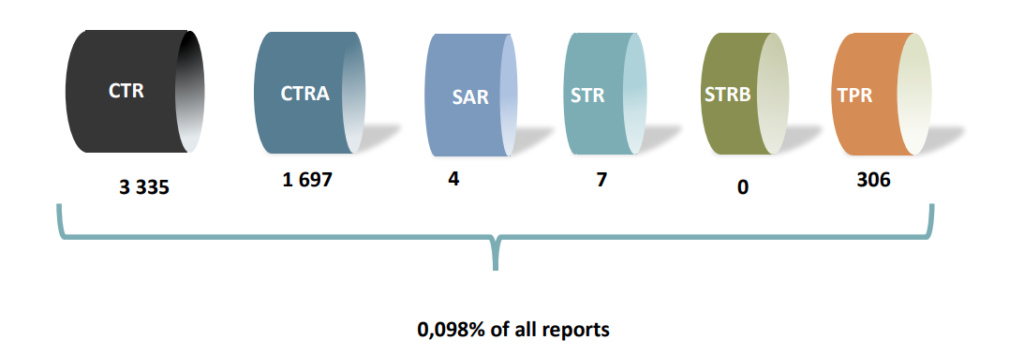

- Effectively submit regulatory reports to the FIC.

FIC’s website: http://www.fic.gov.za

Product Risk Rating in the CIS space will largely assist business in ensuring that their businesses are not used as vehicles for money laundering. There are therefore a couple of factors to consider in ensuring FIC compliance.

Rahn Consolidated has conducted rigorous reviews on CIS and has seen the extent to which ML is prominent in this business including failure to trace source of income or wealth. As part of its CDD services, Rahn Consolidated has developed a tool to formally customise the needs of a CIS business to curb ML risks.

Assess product risk for ML requirements: points to note

Third (3rd) party payments

Assessments need to be made on whether there are any 3rd party payments on the product. With reference to Unit Trusts within the CIS space, 3rd party payments are usually allowed and this implies that CDD should be conducted prior to payment being made.

Regulated product

Part of Rahn Consolidated’s assessments will be based on whether the Unit Trusts are regulated products which makes it easy to assess its features and assess different levels in which ML may be prominent.

Transaction types

The types of transactions that are conducted in each product is very critical as it should also assess whether the CIS type of product allows a lot of cash injection or not. In assessing this, Rahn Consolidated conducts an assessment as to whether the usage of the product entails structured transactions such as periodic payments at fixed intervals or whether it facilitates an unstructured flow of funds. The results of such assessment will trigger, amongst others, cash transaction reporting and overall rating of the product.