Lending money against security of securities

Is your business lending and receiving dirty money? A study on business of lending money against security of securities.

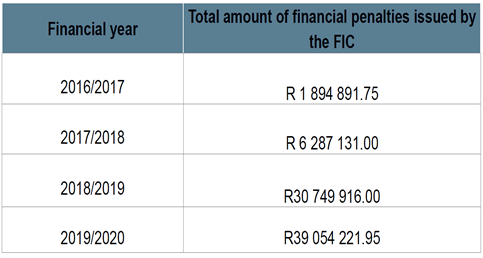

Rahn Consolidated (Pty) Ltd’s (“Rahn Consolidated”) articles and case studies are aimed at socialising, climatising, creating awareness and cautioning economic participants on regarding economic crime schemes. The focus will inter alia be on the investigations around Lending money against security of securities , risks, reporting and most importantly, its regulatory compliance. The term “Economic crime schemes” are often used interchangeably with “Financial Crime”. For the purpose of ensuring all readers are kept in the loop, Rahn Consolidated will make use of both terms. Rahn Consolidated being at the forefront of deterring Financial Crime through compliance will focus primarily on the compliance of regarding Financial Crime and ensuring fines by way of administrative sanctions that fines are mitigated as much as possible.

Issue No.11 focuses on businesses registered as lenders of money against securities and mostly provide clarity on credit providers. This article aims to inform readers of what item 11 of schedule 1 of the Financial Intelligence Centre Act (FIC Act) refers to and how such businesses can implement controls to mitigate risks relating to Money Laundering and Terrorist and Proliferation Financing (ML/TPF) in their business.

Enjoy the read!

Item 11 of Schedule 1 of the Financial Intelligence Centre (FIC) Act identifies an Accountable Institution (AI) as a person who carries on with the business of lending money against the security of securities.

Firstly, it is very important to note that credit providers are regulated by the National Credit Act (NCA). The business of lending money against securities on the other hand is regulated by the Financial Intelligence Centre Act as an AI and supervised by the Financial Sector Conduct Authority (FSCA) due to the use of securities.

The Financial Action Task Force (FATF) Mutual Evaluation Report, explains explicitly the exclusion of Credit Providers from being an AI:

FATF Mutual Evaluation Report_October 2021

It is therefore possible to exclude credit providers as AIs, but including the money lenders against securities.

The table below depicts South Africa’s situation regarding registration and supervision of credit providers vs money lenders against securities

| Type | No. Total | | No. Registered | | Subject to ML/TPF obligations | | ML/TPF Supervisor |

| Credit providers | 6 895 | 6 895 | No | NCR (N/A) |

| Among which, money lenders against securities | 76 | 76 | Yes | FIC and FSCA |

Furthermore, there has not been an recorded ML/TPF sanctions reported on credit providers apart from those that conduct business as money lenders against securities.

- The reference in item 11 of schedule 1 of the FIC Act to a person who lends money against the securities relates to the Stock Exchange Control Act.

- The Stock Exchange Control Act refers to a “carrier against shares”. Note that this Act was repealed by the Financial Markets Act (FMA).

- This definition refers to a practice where a trader could lend money to a client to fund a purchase of shares against the security of shares bought by the client in the previous trade.

- Item 11 specifically relates to securities with particular reference to instruments that are traded on an exchange such as shares, debentures and futures contracts.

- All securities defined in the FMA are included in this definition contained item 11 of schedule 1.

- In conclusion, item 11 of schedule 1 excludes credit providers apart from those that lend money against securities.

- To provide some context, Rahn Consolidated will highlight some features of these securities in line with the FMA.

Securities as defined in the Financial Markets Act (FMA):

- Shares, depository receipts and other equivalent equities;

- Debentures and bonds;

- Derivatives instruments;

- Notes;

- Instruments based on an index;

- Units or any other form of participation in a collective investment scheme;

- Money market securities;

“Credit providers, other than money lenders against securities, are not subject to ML/TPF obligations except the general requirements to file a Suspicious Transaction Report (STR) that applies to any business that is not subject to supervision or monitoring.”

Apart from Reporting obligations, business of lending money against securities have to comply to the below FIC Act requirements:

- Register business as an AI with the FIC in order to ensure regulatory reporting through go-AML;

- Develop a Risk Management and Compliance Programme (RMCP);

- Conduct Customer Due Diligence (CDD);

- Develop a compliance framework and appoint a compliance officer;

- Conduct training on AML/CTPF risks and controls;

- Effectively keep records; and

- Effectively submit regulatory reports to the FIC.

FIC’s website:http://www.fic.gov.za

ML/TPF risks notes: Money lending institutions against securities

Background: A possible scenario could be where a client applies for a loan to purchase a house. In this example, a unit trust which is part of a collective investment schemes (CIS) as defined in the FMA as one of the securities. The client provided security of around 30% of the loan by putting a lump sum into a unit trust (CIS). He later withdrew the investment early to pay back the loan (capital and interest), making up the shortfall through other funds whose source is unknown.

Money Laundering Risks Identified and trigger events for FIC Act compliance

The use a proportion of the loan to purchase a unit trust combined with the unexpectedly early repayment of the loan led to the accountable institution filing a suspicious transaction report with the FIC. The suspicious transaction report is most likely to assist the authorities to identify gaps where there were schemes in loans granted and utilised to launder money through the unit trust or CIS. Rahn Consolidated assists with effective reporting controls.