AML Trust – RAHN CASE STUDY ISSUE NO.5-2022

How to instill AML Trust in Trust Companies

The aim of the Rahn Consolidated articles and case studies is to socialise and acclimatise economic participants to economic crime schemes. The focus will inter alia be on the investigations around aml trust, economic crime schemes, risks, reporting, and most importantly its regulatory compliance. The term, economic crime schemes, is often used interchangeably with Financial Crime, and for the purpose of this article, both terms will be used interchangeably.

Rahn Consolidated, being at the forefront of deterring Financial Crime through compliance, will focus primarily on compliance with Financial Crime legislation thus ensuring fines by way of administrative sanctions are mitigated as much as possible.

Issue No.5 deep dives into Trust companies as defined by the Trust Property Control Act and includes company service providers as defined by the Financial Action Task Force (FATF). Trust Companies are Accountable Institutions (AIs) as contemplated in schedule 1 of Financial Intelligence Centre Act (FIC Act). Trust Companies are therefore all liable to comply with all requirements and duties of AIs in the FIC Act.

This article will assist Trust Companies to know what they should comply with as far as Anti-Money Laundering (AML) and Counter-Terrorist and Proliferation Financing (CTPF) are concerned and further highlight the risks of non-compliance thereof.

Enjoy the Read!

FATF definition of Trust and Companies Service Providers relates to providers of Trust Company services that excluded financial institutions, lawyers, notaries, other independent legal professionals, and accountants.

A Trust Company in the South African context implies a legal arrangement whereby ‘control’ of property is transferred to a person or organisation (the trustee) for the benefit of someone else (the beneficiary). There are two types of trusts that can be registered i.e., inter-vivos trust and testamentary trust.

As an AI, the Trust company, as defined, should at a minimum comply with the below:

- Register business as an AI with the FIC to ensure regulatory reporting through go-AML;

- Develop a Risk Management and Compliance Program (RMCP);

- Conduct Customer Due Diligence (CDD);

- Develop a compliance framework and appoint a compliance officer;

- Conduct training on AML/CTPF risks and controls;

- Effectively keep records; and

- Effectively submit regulatory reports to the FIC.

FIC’s website: http://www.fic.gov.za

According to the FATF Recommendations, Trust companies provide a range of services and activities that largely differ from one to the other. The difference typically lies in the way each AI will be susceptible to ML/TF risks and is based on the method of the Trust Company’s delivery, the nature of customer relationships, and the size of the company.

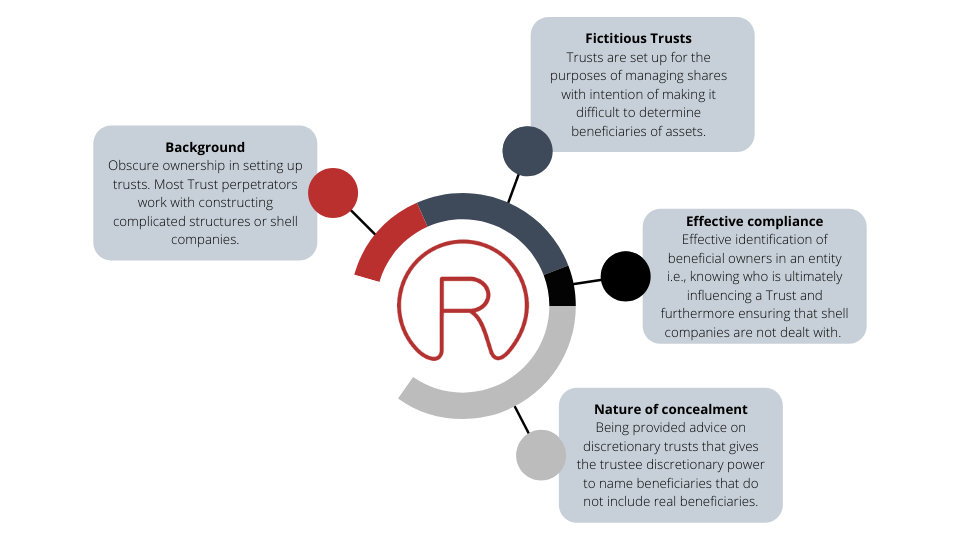

Vulnerabilities of Trust Companies in ML/TF

- Trust companies are seen as potentially useful vehicles to retain control over criminally derived assets;

- Criminals may conduct this through opening shelf companies that are used as non-operational companies; and

- Criminals’ modus operandi with these types of companies is to gain control over them and in turn control the property associated with them. It should be noted that “property” is defined in the Prevention of Organised Crime (POCA) as any movable, immovable, corporeal or incorporeal element that includes rights, privileges, and interests.

Recent stats on registration and reports received of Trust Company as Accountable Institutions:

In the past 2 years, the registration of Trust Companies with the Financial Intelligence Centre (“FIC”) has grown from 173 to 189 indicating a gradual growth in the industry recognising their compliance requirement as set out in the FIC Act.

Trust Companies that are registered as Ais, have largely contributed to the ability to curb AML/ CTPF risks by submitting amongst others, suspicious reports, and cash threshold reports to the FIC to ensure that they comply with the reporting obligations.

“What is quite common with Trust Companies is its correlation with legal practitioners that was alluded to in Issue 4 due to the transfers of funds and property activities in this industry.”

Red flags to focus on from a Trust Company and Trust Attorneys to curb AML/CTPF risks:

From the above possible red flags, it is imperative to note that several types of AIs may work in correlation and therefore be required to provide dual reporting. What is quite common with Trust Companies is its correlation with legal practitioners that were alluded to in Issue 4 due to the transfers of funds and property activities in this industry. We will see more correlation with all AIs, be on the lookout for dual compliance requirements!

Unusual payments to an attorney’s trust account- Trust Companies should have capabilities to detect such unusual payments. Rahn Consolidated provides such services to various AIs including Trust Companies.

Transfers from the attorney’s trust account to purchase high-end goods, luxury properties, and vehicles. These transactions can constitute suspicious transactions and will assist the FIC to “follow the money” and identifying any ML/TF activities that may be happening around the Trust Companies.

Routing of funds via attorneys’ trust accounts to purchase high-end goods, luxury properties, and vehicles.

The FIC Act with the new FATF recommendations will now focus on compliance of Trust companies with regards to beneficial ownership and customer due diligence at large. Ask Rahn Consolidated how to get your entity compliant.