Impact of Grey Listing South Africa – RAHN CASE STUDY ISSUE NO.20-2022

Financial Intelligence Centre Act and Financial Action Task Force Recommendations: A case study on the industry impact of South Africa’s Finance Laws.

Rahn Consolidated’s articles and case studies are aimed at socialising, climatising, creating awareness, and cautioning economic participants regarding economic crime schemes. The focus will be on anti-money laundering and the investigations around economic crime scheme risks, reporting, and most importantly, its regulatory compliance. The term “Economic crime schemes” is often used interchangeably with “Financial Crime”.

In June 2021, the Financial Actions Task Force (FATF) highlighted deficiencies in South Africa’s AML/CFTPF regime. The report issued by the FATF, lists a set of “priority actions”. That government‘s required to take before October 2022.

ISSUE NO.20-2022, focuses on South Africa’s requirement to report on the progress made in the FATF plenary in October 2022. If FATF deems the progress to be insufficient. It will be decided on whether South Africa should be placed on a “Grey list”.

The “Grey list” contains a list of jurisdictions. They are under increased monitoring and are required to address strategic deficiencies in their regimes. To counter money laundering, terrorist financing, and proliferation financing. From an industries perspective, when the FATF places a jurisdiction under increased monitoring. It means the country has committed to swiftly resolve the identified strategic deficiencies. Within agreed timeframes and is subject to increased monitoring.

Enjoy the Read!

The Impact of Grey listing South Africa

Countries that would be placed on the grey list are subject to face economic sanctions from development funders like the European Union and the World Bank. Once there is enhanced monitoring of a country based on the Grey listing, the enhanced monitoring requirements could also impose a burden on global

financial counterparts, such as foreign banks or investors, who will be required to implement additional measures/controls when doing business with entities within Gray listed countries. Many global banks and investors have policies against engagements with Grey listed countries.

Policies Implementation in South Africa to curb AML/CTF&P

The FATF recommended that South African authorities develop policies to address higher risks of money laundering and terrorist financing. It also suggested policymakers provide the Directorate for Priority Crime Investigation (the Hawks) with more staff, especially financial investigators, and forensic accountants.

Given this, the treasury and the Financial Intelligence Centre had already started reviewing South Africa’s anti-money laundering and counter-terrorist financing legislation. The amendments to the FIC Act have widened its scope by including more categories of institutions and businesses that must adhere to the duties of accountable institutions that are not only limited to reporting of suspicious transactions.

The below key amendments were made to the FIC Act :

The objectives of the Financial Intelligence Centre (“Centre”);

- The functions of the Centre include the provision of forensic informatio. Empowering the Centre to request information held by other organs of state;

- Providing for additional and ongoing due diligence measures. Amending the process followed when there are doubts about the veracity of information;

- Aligning certain provisions and Schedules 3A and 3B. To appropriately refer to domestic and foreign “politically exposed persons”. As distinct from “politically influential persons”, who will deal with in a new Schedule 3C;

- Certain provisions relating to resolutions of the Security Council of the United Nations. By amending the powers of access by authorised representatives to records of accountable institutions;

- Enabling the Centre to renew a direction not to proceed with a transaction;

- by providing for the safeguarding of information;

- The provisions relating to the disclosure of information to the Centre and access to information by the Centre;

- Empowering Minister to prescribe appropriate requirements relating to access to personal information. To ensure that adequate safeguards are in place. As required by section 6(1)(c) of the Protection of Personal Information Act, 2013;

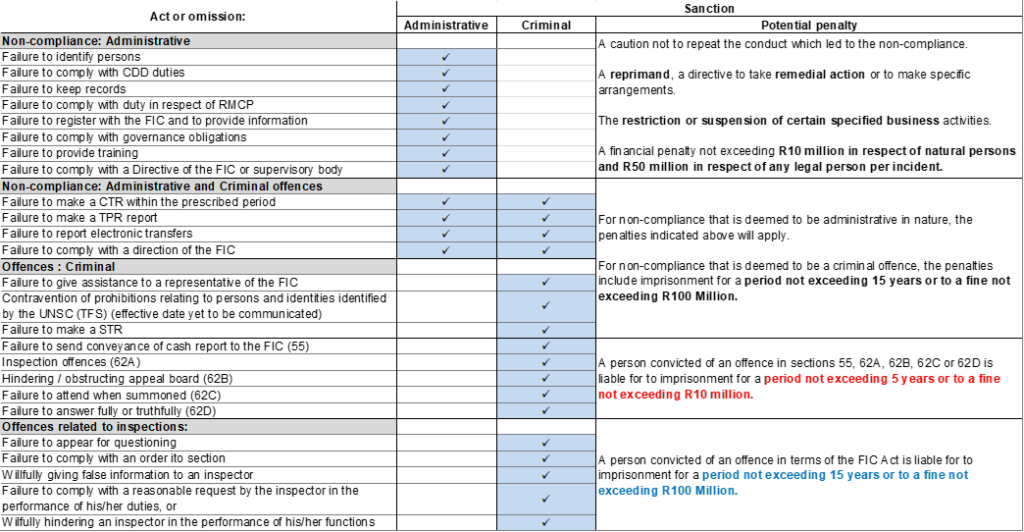

- Certain provisions relating to the risk management and compliance programme. By amending the offences provisions to empower the imposition of administrative sanctions;

- The provision relating to the amendment by the Minister of Schedule 2; and

- Schedules 2, 3A and 3B, and by inserting a new Schedule 3C.

Lessons from other Countries regarding the Grey List:

Mauritius was taken off the Grey list after one year when meeting all requirements and continues to make great strides in improving its AML/CFTPF regime.

Botswana was removed in October 2021 after meeting the FATF requirements. It took the country three years to succeed, during which time it was automatically included in the EU’s list of non-compliant countries.

Pakistan has an economy roughly the same size as South Africa’s and has been estimated to have lost USD38bn (R600bn)* of economic activity from 2018 to 2019 as a result of being Grey-listed in 2018. In March this year, the FATF plenary kept the country on the grey list despite it having completed 26 of the 27 action items required by the FATF, which indicates that getting off the list is not a simple task.

While South Africa is currently on the watch-list for the Grey List. It is all financial industries’ duties to ensure compliance.

The duties to which Accountable Institutions (Financial Industries) should adhere to. In order to avoid being grey-listed you should include the below:

- To develop a Risk Management and Compliance Programme (RMCP);

- Conduct Customer Due Diligence (CDD) and ensuring that all clients are identified, verified, screened and risk rated;

- To develop a risk based framework that would allow the financial industries.

- To curb risks relating to money laundering and terrorist and proliferation financing;

- Develop a compliance framework and appoint a compliance officer;

- Conduct training on AML/CTPF risks and controls;

- Effectively keep records; and

- Effectively submit regulatory reports to the FIC.