Adverse Media and AML Compliance: Why It Matters

How Adverse Media and AML Compliance Protect Your Business

In today’s interconnected business landscape, Adverse Media and AML Compliance are no longer optional—they are strategic necessities. Regulators are tightening controls, financial crimes are becoming more sophisticated, and reputational risk can spread globally in minutes. Yet, one of the most overlooked components of a robust compliance programme is adverse media screening.

For businesses operating in financial services, legal, retail, or any sector exposed to third-party risk, failing to monitor adverse media can be the difference between protecting your brand and facing regulatory fines, loss of client trust, or worse.

What Is Adverse Media Screening?

Adverse media screening is the process of checking individuals and entities against news reports, online publications, and global data sources to identify potential red flags. These can include:

- Allegations of fraud, corruption, or money laundering

- Links to organised crime or terrorism financing

- Negative press around sanctions, regulatory breaches, or misconduct

Unlike standard database checks, adverse media digs deeper. It provides context, highlighting issues that may not yet have led to criminal convictions but still pose a significant reputational or regulatory risk.

Why Adverse Media Matters for AML Compliance

- Regulatory Expectations

Authorities such as the Financial Intelligence Centre (FIC) in South Africa and global regulators expect companies to adopt a risk-based approach. Ignoring adverse media could be seen as a failure in due diligence, exposing your business to penalties. - Protecting Reputation

In the digital era, reputational damage spreads faster than ever. A single overlooked connection to negative press can compromise years of brand-building. - Early Risk Detection

Adverse media monitoring allows you to identify risks before they escalate into legal or financial consequences. This proactive approach saves time, money, and resources. - Client & Investor Confidence

Strong AML controls reassure clients and stakeholders that your business takes compliance and ethics seriously.

Common Challenges Businesses Face

- Data Overload: Sifting through thousands of articles and sources can overwhelm compliance teams.

- Language Barriers: News often breaks in local languages, which complicates monitoring.

- Manual Processes: Relying on human-only checks increases costs and the risk of errors.

The Smarter Approach: AI-Driven Adverse Media Screening

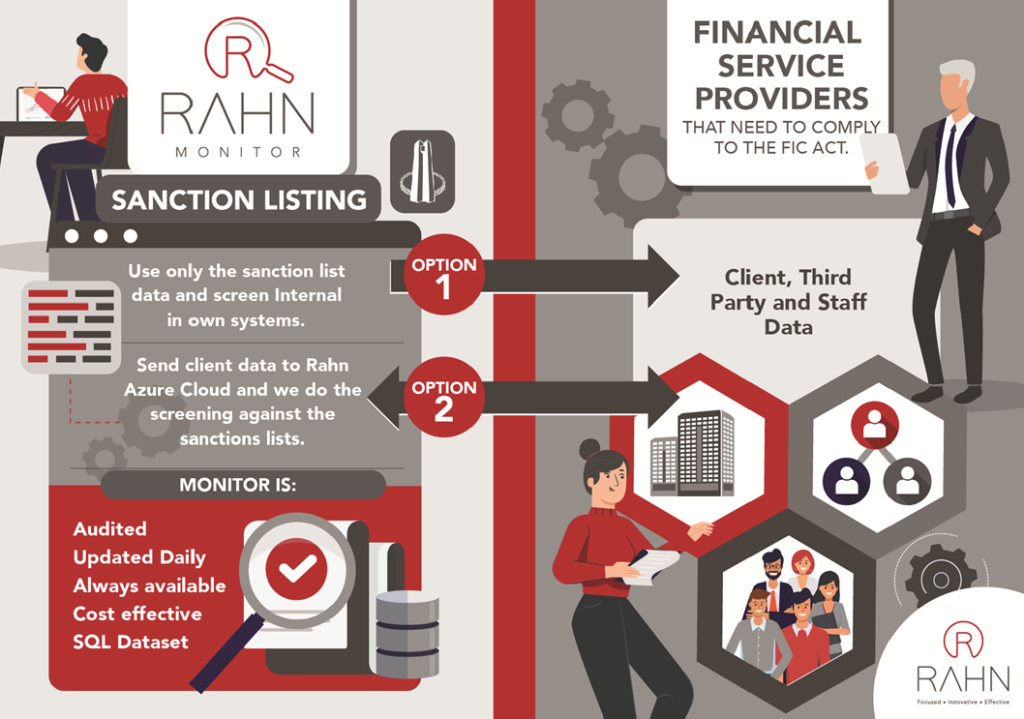

Modern businesses are turning to AI-powered tools like Rahn Monitor to automate adverse media checks. These solutions scan vast networks of over 200,000 global sources, combining artificial intelligence with regulatory expertise to deliver accurate, actionable insights.

Benefits include:

- Real-time monitoring and alerts

- Multilingual coverage

- Integration with existing AML systems

- Reduced compliance costs

Why Your Business Cannot Afford to Ignore It

- Non-compliance fines can run into millions.

- Operational disruption occurs when regulators flag weak AML frameworks.

- Loss of trust damages client relationships beyond repair.

By investing in robust adverse media screening, you safeguard your business, strengthen compliance, and create long-term value.

How RAHN Can Help

At RAHN, we provide businesses with the tools to simplify compliance, protect reputations, and stay ahead of regulatory change. Our RAHN Monitor platform combines speed, accuracy, and scale giving you confidence that your AML processes are resilient, future-proof, and aligned with global best practices.

Ready to strengthen your compliance framework? Get in touch with us today and discover how RAHN can help you implement effective adverse media and AML solutions.

Mail us today at [email protected]