Money Laundering in Casinos – RAHN CASE STUDY ISSUE NO.15-2022

Tossing the dice to curb money laundering- a study on curbing money laundering in casinos

Rahn Consolidated (Pty) Ltd’s (“Rahn Consolidated”) articles and case studies are aimed at socialising, climatising, creating awareness and cautioning economic participants on regarding economic crime schemes. The focus will inter alia be on the investigations around money laundering in casinos, risks, reporting and most importantly, its regulatory compliance. The term “Economic crime schemes” are often used interchangeably with “Financial Crime”. For the purpose of ensuring all readers are kept in the loop, Rahn Consolidated will make use of both terms. Rahn Consolidated being at the forefront of deterring Financial Crime through compliance will focus primarily on the compliance of regarding Financial Crime and ensuring fines by way of administrative sanctions that fines are mitigated as much as possible.

Issue No.15 focuses on the Gambling industry, also widely referred to as the Casino and Gaming industry. The risks that are associated to this industry are related to Money Laundering (ML) and Terrorist Financing (TF) due to the cash exposure inherent with the industry.

The different activities carried out, such as land-based casinos and internet-based casinos, are all susceptible to ML and as such business that operate within this industry should always ensure that they are compliant with the ML/TF laws particularly the Financial Intelligence Centre Act, as amended. This article aims to highlight the bare minimum requirements and highlighting the risks thereof.

Item 9 of Schedule 1 of the Financial Intelligence Centre (FIC) Act identifies and Accountable Institution (AI) as a person who carries on the business of making available a gambling activity as contemplated in section 3 of the National Gambling Act, 2004, in respect of which a license is required to be issued by the National Gambling Board or a provincial licensing authority.

Enjoy the Read!

Considerations for the Casino and Gaming Industry:

Land-based casinos vary in a number of key areas which may impact the specific money laundering or terrorist financing risks that they are exposed to, e.g. types of gambling offered, location, speed and volume of business, the payment methods accepted from customers, size of premises, customers (regular customers with

(regular customers with membership rules or passing trade such as casual tourists or organised casino tours), whether the casino owner forms part of a larger organisation owned by the same operator, and the general regulatory environment that the casino operates within. Internet casinos also vary, e.g.,

whether the operator has other web sites, or whether an operator’s server is in a different country from other parts of its business. These differences contribute to significant differences between land-based and internet casinos in a number of key areas, including customer contact.

Casinos are subject to a range of regulatory requirements, commercial considerations, and security measures, which can complement AML and CFT measures:

- Age verification

- Financial crime controls

- Social responsibility provisions

- Security controls

- Gaming surveillance, e.g., to deal with problem gambling.

FATF GAMBLING RBA

From a reporting perspective, the Gambling industry only constitutes about 5.71 % of the total reporters (including both accountable institutions and reporting institutions).

Rahn Consolidated can assist this highly cash intensive AI in assisting with compliance related to financial crime and embedment of controls thereof.

ML/TPF Risks Case study: Casinos and Gaming

The below is a lay-out of the Gaming industry over a couple of years and the inspections which were covered by the Regulators. This highlights the significance of this industry and to what extend these industries are at risk to ML/TF.

| Type | 2015 | 2016 | 2017 | 2018 | 2019 | Total | Average | Percent |

| Casino | 38 | 47 | 24 | 29 | 23 | 161 | 32 | 8% |

| Bingo | 23 | 27 | 24 | 27 | 41 | 143 | 28 | 7% |

| Bookmaker | 132 | 132 | 122 | 135 | 236 | 757 | 151 | 39% |

| Limited Payout Machines | 110 | 195 | 124 | 1149 | 314 | 892 | 178 | 46% |

| Total | 303 | 401 | 294 | 340 | 614 | 1952 | 390 | 100% |

FATF MER

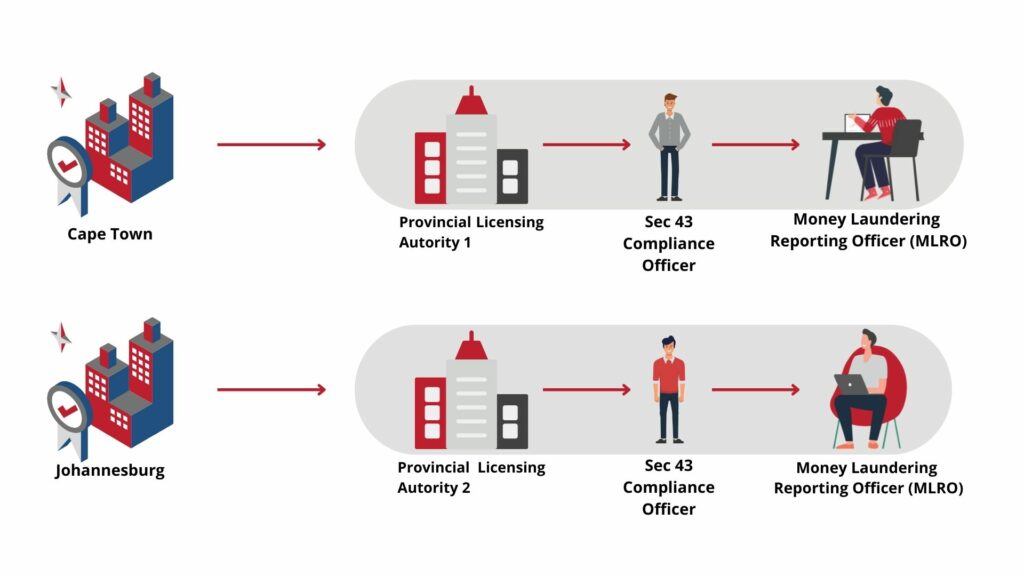

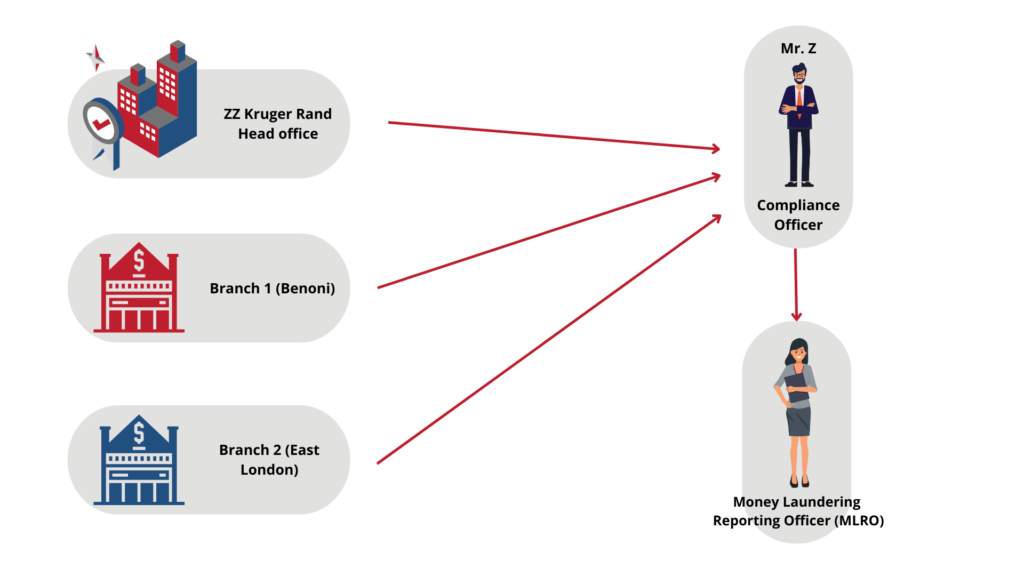

Example of Gambling (Casinos, Bookmakers etc.) registration and its structure

XYZ Casino and XYZ bookmakers share a premises in Johannesburg and in Cape Town. 2 Licenses are issued by the responsible supervisory body being the relevant provincial licensing authority. This means that 2 registrations must occur. Multiple Money Laundering Reporting Officers (MLROs) can be added per accountable institution. The MLRO will only be able to see reporting and registration information of that accountable institution.