Follow the Money – RAHN CASE STUDY ISSUE NO.9-2022

Deep-diving into Anti-Money Laundering/Counter Terrorist and Proliferation Financing (AML/CTPF) in the Banking Industry- “Follow the Money Principle”

Rahn Consolidated (Pty) Ltd’s (“Rahn Consolidated”) articles and case studies are aimed at socialising, climatising, creating awareness and cautioning economic participants on regarding economic crime schemes. The focus will inter alia be on the follow the money principle, investigations around economic crime schemes, risks, reporting and most importantly, its regulatory compliance. The term “Economic crime schemes” are often used interchangeably with “Financial Crime”. For the purpose of ensuring all readers are kept in the loop, Rahn Consolidated will make use of both terms. Rahn Consolidated being at the forefront of deterring Financial Crime through compliance will focus primarily on the compliance of regarding Financial Crime and ensuring fines by way of administrative sanctions that fines are mitigated as much as possible.

Issue No.9 focuses on one of the most prominent Accountable Institutions (AIs) which is inherently a high risk money laundering “machine” due to its very high volume of transactions.

In this issue, Rahn Consolidated’s approach in this regard is to draw the reader’s attention to specific banking requirements relating to AML/CTPF. This issue will also pinpoint Financial Crime risks as a whole in the banking industry alongside Money Laundering/Terrorist and Proliferation Financing (ML/TPF). The banking industry’s actions relating to ML/TPF should be focused on strategies that mitigate these risks and similarly taking into account the regulatory frameworks at both country, business and client levels. The regulatory framework controlling the banking industry is so vast that non-compliance could result in serious administrative sanctions.

Enjoy the Read!

Item 6 of Schedule 1 of the Financial Intelligence Centre (FIC) Act identifies an Accountable Institution as a person who carries on the business of a bank as defined in the Banks Act, 1990 as amended by Act 9 of 1993 (“the Bank Act”). A Bank is defined as a public company registered provisionally or finally as a bank for purposes of inter alia deposit taking.

Assessing ML/TPF Risks in the banking industry

Due to the high volume of transactions in the banking industry, there appears to be more risks associated with banks in this regard.

From a Financial Action Task Force (FATF) perspective, there are evolving risks in which banks should ideally look into that largely affect the operational controls of a bank to enable effective compliance.

The following are money laundering risks and their correlation to other financial crimes, indicating how banking officials would curb the risks if they were to “follow the money”:

- Incidents of corruption and bribery are widespread and do not take place in isolation as the proceeds are always layered and integrated back into the industry through money laundering, resulting in banks being very susceptible.

- Digital banking fraud, including virtual assets, are also prominent amongst other types of ML fraud.

- Effective banking systems and networks assist in exposing and potentially identifying the proceeds of Terrorist and Proliferation Financing through the flow of transactions in South Africa.

- Banks need to place more focus on cross-border transactions and impose restrictions after conducting screening procedures and sanctions.

FATF Mutual Evaluation Report

Stricter measures of ML have always been placed on the banking industry. In the FATF immediate outcomes it was found that:

- To a certain extent, the ‘big four’ banks show more a more developed understanding of ML risks. This simply implies that there is traction in embedment of ML risks, however this also implies that the regulators/authorities and supervisors will be much stricter in ensuring that ML risks are prevented effectively.

- To a certain extent, the ‘big four’ banks meet reporting obligations. Taking into account the dual reporting mandate on different AIs, it is imperative for each AI to ensure complete compliance with all obligations contained in the FIC Act.

- Out of 34 registered Banks in South Africa with combined total assets of around R 5 517.00 Billion Rands reported between 2019-2020, it is a bit concerning that the Mutual Evaluators were to a certain extent only satisfied with what is called the ‘big four’ banks. There is definitely still a lot of intervention required in this regard.

“When assessing the effectiveness of preventative measures and AML/CFT supervision, the assessment team assigned the highest importance to banks “

About 88% of the total reports submitted to the Financial Intelligence Centre emanate from Banks – 4 595 579 to be precise,. Rahn Consolidated assists all types of banks in automation and refinement of these reports.

Apart from Reporting obligations, banks have to comply with the following FIC Act requirements:

- Register the bank as an AI with the FIC in order to ensure regulatory reporting through go-AML;

- Develop a Risk Management and Compliance Programme (RMCP);

- Conduct Customer Due Diligence (CDD);

- Develop a compliance framework and appoint a compliance officer;

- Conduct training on AML/CTPF risks and controls;

- Effectively keep records; and

- Effectively submit regulatory reports to the FIC.

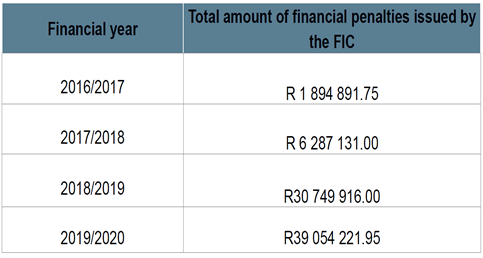

Below are the total number of sanctions imposed on Accountable Institutions, including Banks:

FIC’s website: http://www.fic.gov.za

There appears to be more work needed to be more compliant and reduce penalties!

ML/TPF Risks points to note (including broader Financial Crime risks in view of “follow the money”)

Ponzi Scheme implication to banks

Perpetrators often need to have a vehicle to enable them to transact with their illicit funds. A Ponzi scheme’s modus operandi uses non-existent business to lure investors to deposit money for purposes of defrauding them using an entity that does not have a return. In a Ponzi scheme, a bank account needs to be opened. Banks are urged to implement stricter measures before accepting a business relationship with prospective clients.

As part of Rahn Consolidated’s services, Customer Due Diligence is effectively conducted by ensuring that clients are identified and verified and that beneficial owners are screened and risk rated. Assessing where money comes from (source) also assists immensely in curbing risks. AIs need to implement freezing of assets while conducting investigations.

Multiple Accounts implications to banks

Having effective transaction monitoring capabilities assist banks to have a single view of accounts and as a result detect all suspicious/unusual activities and transactions across the bank. A particular case study that affected the Financial Intelligence Centre involved detection of multiple accounts between the same institutions and individuals.

FIC capabilities to be implemented in this regard include but is not limited to transactional monitoring, assessing business relationships and determining the source of income.

Rahn Consolidated assists banks in verifying clients and monitoring transactions regularly in order to identify ML/TPF risks.

FATF RBA Banking Industry