How Section 28 Compliance Impacts Cash Transaction Reporting and Sanctions Screening

Section 28 compliance came into focus when the South African Reserve Bank recently issued a notice declaring that administrative sanctions had been imposed on two life insurers following an investigation that found weaknesses in their anti-money laundering control measures. This case study, which forms Part 2 of our Financial Crime Compliance series, takes a closer look at the Section 28 findings and explains how the Rahn Financial Compliance Platform can be employed to strengthen Section 28 compliance and overall anti-money laundering control measures in your business.

Section 28 Compliance of the FIC Act

“28. Cash transactions above the prescribed limit

An accountable institution and a reporting institution must, within the prescribed period, report to the Centre the prescribed particulars concerning a transaction concluded with a client if in terms of the transaction an amount of cash more than the prescribed amount—

(a) is paid by the accountable institution or reporting institution to the client, or to a person acting on behalf of the client, or to a person on whose behalf the client is acting; or

(b) is received by the accountable institution or reporting institution from the client, or from a person acting on behalf of the client, or from a person on whose behalf the client is acting.

28A. Property associated with terrorist and related activities and financial sanctions pursuant to Resolutions of United Nations Security Council

(1) An accountable institution which has in its possession or under its control property owned or controlled by or on behalf of, or at the direction of—

(a) any entity which has committed, or attempted to commit, or facilitated the commission of a specified offence as defined in the Protection of Constitutional Democracy against Terrorist and Related Activities Act, 2004;

(b) a specific entity identified in a notice issued by the President, under section 25 of the Protection of Constitutional Democracy against Terrorist and Related Activities Act, 2004; or

(c) a person or an entity identified pursuant to a resolution of the Security Council of the United Nations contemplated in a notice referred to in section 26A(1), must within the prescribed period report that fact and the prescribed particulars to the Centre.

(2) The Director may direct an accountable institution that has made a report under subsection (1) to report —

(a) at such intervals, as may be determined in the direction, that it is still in possession or control of the property in respect of which the report under subsection (1) had been made; and

(b) any change in the circumstances concerning the accountable institution’s possession or control of that property.

(3) An accountable institution must upon—

(a) publication of a proclamation by the President under section 25 of the Protection of Constitutional Democracy against Terrorist and Related Activities Act, 2004; or

(b) notice being given by the Director under section 26A(3),

scrutinise its information concerning clients with whom the accountable institution has business relationships to determine whether any such client is a person or entity mentioned in the proclamation by the President or the notice by the Director.”

What must happen, in order to meet Financial Crime Compliance

To meet Section 28 compliance, an accountable institution must monitor all incoming and outgoing transactions concluded with or by clients to identify cash transactions across any of the institution’s bank accounts. This monitoring for Section 28 compliance must be applied retrospectively and on an ongoing basis. Once identified, it must be determined whether any transactions breach the prescribed cash threshold levels. In the event of a breach, a CTR report must be completed and submitted via the GoAML portal to the regulator in line with Section 28 compliance requirements.

At this stage, many institutions encounter challenges, particularly when attempting to identify the client who made a cash deposit (excluding the banking industry). These challenges often arise because clients use their own references on deposit slips, making it difficult to reliably assign a transaction to a specific client and thereby increasing Section 28 compliance risk.

Many accountable institutions consist of multiple reporting institutions, each potentially operating several bank accounts for different business purposes. This complexity further complicates Section 28 compliance, as incomplete account coverage or unclear ownership structures may result in missed cash threshold breaches and adverse findings during regulatory inspections.

The next part of Section 28 compliance addresses the actions required when an accountable institution controls or manages property—such as investments, insurance policies, or pension funds—belonging to individuals listed under the Protection of Constitutional Democracy against Terrorist and Related Activities Act or United Nations Security Council sanctions lists. This aspect of Section 28 compliance follows similar principles to DPIP screening, requiring institutions to identify sanctioned individuals who may pose financial crime and money laundering risks. Accountable institutions are therefore expected to screen both current and prospective clients to ensure that property under their control is reported to the regulator and managed in accordance with Section 28 compliance obligations and lawful instructions.

How does the Rahn Financial Crime Compliance Platform solve for this?

The transaction monitoring module of the RAHN Financial Crime Compliance platform has been designed to consume the account statements as supplied by ABSA, FNB, Nedbank and Standard Bank. We have working relationships with the teams within these banks to ensure automated integration and consumption of the data. Cash threshold breaches are automatically identified via overnight batch runs and can be applied historically. Submission of CTR reports is automated through the workflow process in so far as population and preparation of the XML templates with built-in gated reviews to ensure all reporting is transparent and visible to senior management committees and compliance functions.

The bank account management module is the direct result of the need to prove coverage in complex banking and treasury environments. Each bank account is managed and maintained within the context of the reporting institution to which it belongs and the accountable individual who controls the account.

The bank reconciliation module was developed to assist in identifying the client who made the deposit. The system makes use of the same matching engine as used to identify sanctioned individuals and thus provides an outcome that follows an accuracy hierarchy. Unmatched or low accuracy matches are resolved through the workflow process where business SMEs are empowered through exception reporting to identify and clear these cases.

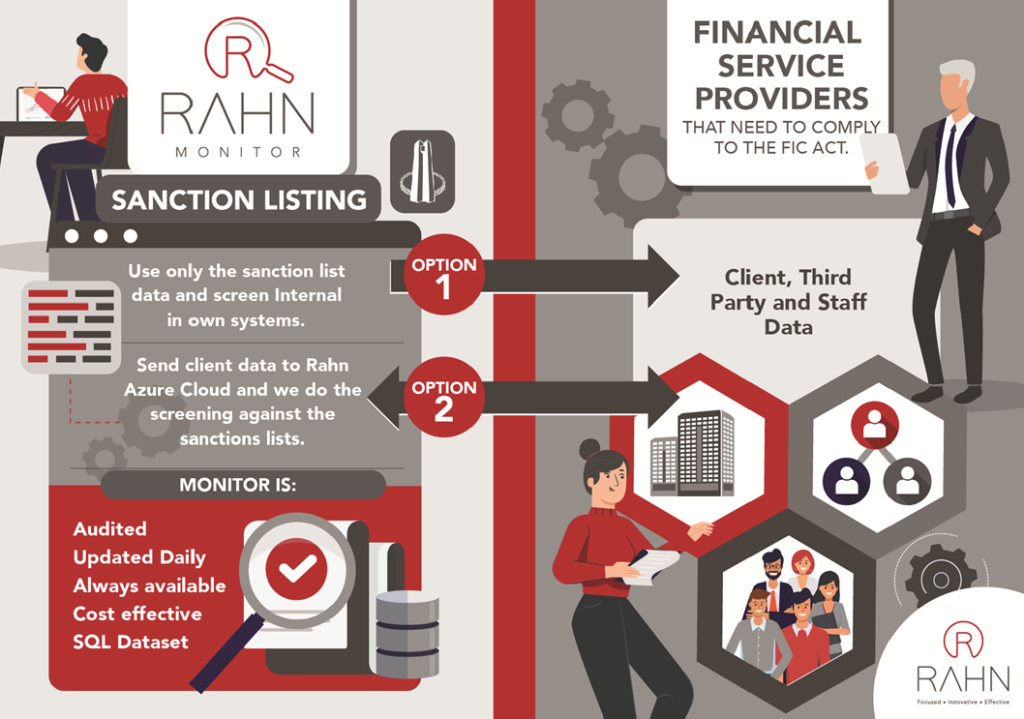

The sanctions matching engine is again applied in the same manner as case study 1 and thus provides the accountable institution with hits against the required sanctions listings. This enables the institution to identify potential terrorist and related activity, and financial sanctions within the client base and thus ensure compliance. The portfolio module allows case managers to build a complete view of a client’s portfolio and thus enables the development of a holistic property holding for everyone who poses the potential to qualify under clause 28A of the Act.

Conclusion

Under Section 28 of the Act, accountable institutions are expected to develop an effective process to identify, manage and monitor cash transactions and identify property holdings for individuals who are deemed to be involved in terrorist and related activities. The Rahn Compliance Platform can assist in this through:

- Identifying cash transactions which breach the prescribed threshold entirely or through aggregation.

- Identify the client who made the deposit through the bank reconciliation module and or the exception workflow process.

- Automated CTR reporting following an approval workflow process and uploaded via the GoAML portal.

- Identification of individuals who are listed on the specified sanction lists with automated workflow process to notify senior management and responsible committees.

- Portfolio view build up capability to identify and ring fence assets belonging to individuals identified under point 4 above.

Tackle Financial Crime and mitigate your Company’s Risks with RAHN

Contact us today at [email protected] to discuss your specific requirements and desired outcomes.