South Africa Has New Banknotes and Coins

South Africa has introduced new banknotes and coins inspired by family, whales, and bees.

Rahn Consolidated’s articles and case studies are aimed at socialising, climatising, creating awareness, and cautioning economic participants regarding economic crime schemes. The focus will be on anti-money laundering and the investigations around economic crime scheme risks, reporting, and most importantly, its regulatory compliance. The term “Economic crime schemes” is often used interchangeably with “Financial Crime”.

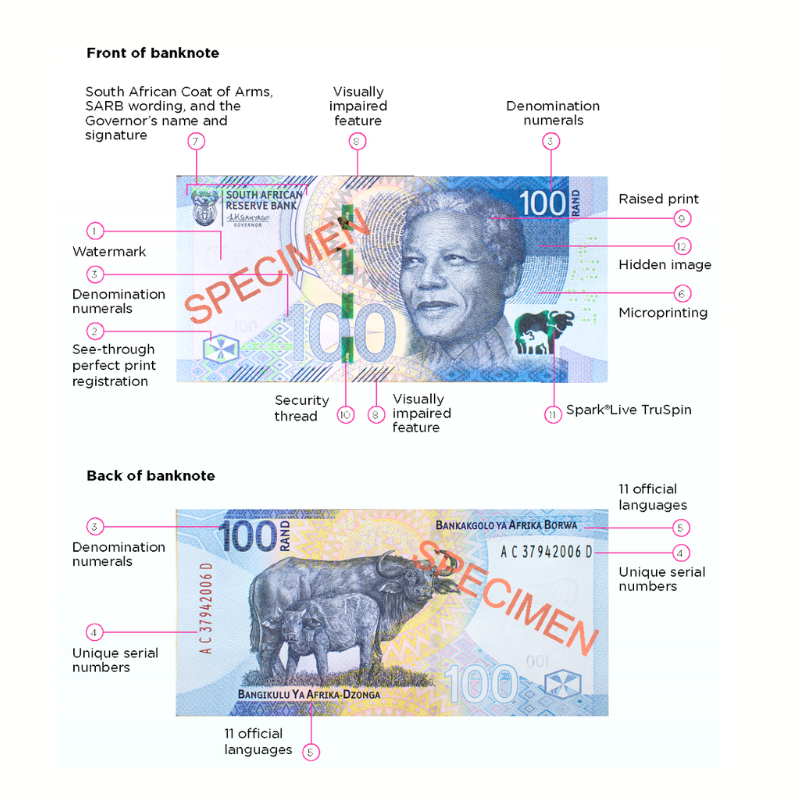

South Africa has introduced new banknotes and coins, the previous notes and coins are now going to be phased out. Below is a case study of how this impacts people who have cash in hand and the impacts this can have on cash threshold reporting from a financial crime perspective.

Image: SARB

ISSUE NO.21-2023, focuses on South Africa’s recently introduced banknotes and coins. This has caused a significant impact on people who have cash in hand. The previous notes and coins are being phased out. This has implications for financial crime prevention, specifically regarding cash threshold reporting.

From a financial crime perspective, cash threshold reporting refers to the obligation of financial institutions. They need to report any cash transactions above a certain threshold to the relevant authorities. This is done to prevent money laundering and other illegal activities.

Enjoy the Read!

The Implications of New Bank Notes and Coins

With the introduction of new banknotes and coins, financial institutions need to implement new controls and checks to ensure that they are accurately reporting cash transactions. This includes updating their systems and procedures to recognize and process the new notes and coins.

For individuals who have cash in hand, the impact of the new notes and coins is significant. They will need to exchange their old notes and coins for new ones before the old ones are phased out. This will require them to go to a bank or other financial institution and exchange their old notes and coins for new ones.

Image: SARB

For those who do not exchange their old notes and coins before they are phased out. They will no longer be able to use them as legal tender. This means that they will have worthless notes and coins. This can have a significant impact on their financial situation.

From a financial crime perspective, the introduction of new notes and coins provides an opportunity for criminals to exploit the system. This is why financial institutions need to implement robust controls and checks to prevent money laundering and other illegal activities.

Image: SARB

The introduction of the new banknotes and coins in South Africa has significant implications. Especially for financial crime prevention, specifically regarding cash threshold reporting. Financial institutions need to implement new controls and checks to ensure that they are accurately reporting cash transactions. For individuals, it is important to exchange their old notes and coins for new ones. Before the old ones are phased out to avoid any financial impact.