Postbank susceptible to Money Laundering

Is the Postbank susceptible to Money Laundering?

Rahn Consolidated (PTY) Ltd’s (“Rahn Consolidated”) articles and case studies are aimed at socialising, climatising, creating awareness and cautioning economic participants on regarding economic crime schemes. The focus will inter alia be on the investigations around Postbank susceptible to Money Laundering, risks, reporting and most importantly, its regulatory compliance. The term “Economic crime schemes” are often used interchangeably with “Financial Crime”. For the purpose of ensuring all readers are kept in the loop, Rahn Consolidated will make use of both terms. Rahn Consolidated being at the forefront of deterring Financial Crime through compliance will focus primarily on the compliance of regarding Financial Crime and ensuring fines by way of administrative sanctions that fines are mitigated as much as possible.

Issue No.17 focuses on schedule 1, item 14 of the Financial Intelligence Centre Act (FIC Act). Which names the Postbank as an accountable Institution.

The purpose of this article is to highlight whether there are areas where the Postbank is susceptible to money laundering. We also would like to highlight areas in which Rahn Consolidated can assist to embed controls in this regard. By definition, a Postbank undertakes activities which are customary for a financial institution carrying on the business of accepting deposits. This therefore implies that with the inflow and outflow of mainly cash. We can already see that there are pertinent requirements in the FIC Act that need to be adhered to.

This article also aims to highlight the risks associated to not embedding any controls to curb money laundering activities.

Enjoy the Read!

Item 14 of Schedule 1 of the Financial Intelligence Centre (FIC) Act identifies the Postbank as an Accountable Institution (AI). As referred to in section 51 of the Postal Services Act, 1998 (Act 124 of 1998). Prior to indicating all Money Laundering risks that may be associated with the Postbank. It is imperative to highlight activities performed by the Postbank in order to arrive at an analysis.

Postbank activities include but are not limited to:

- Money remittance: Money transfer services which include Money remittance through the postal company either within or outside the Republic at rates determined by the postal company. The postal company may authorise any employee to issue and pay money orders, postal orders and other documents authorised to be used for the purpose of so remitting money.

- Bank note: Any money order or postal order is regarded as a bank note or an order for the payment of money and a valuable security within the meaning of any law relating to forgery or theft.

- Any unissued postal order must be regarded as money of the postal company.

- Acceptance of deposits: Some activities of the postal company include acceptance of deposits and making payments to customers, which is customary to a financial service institution.

- Interest on deposits: Interest on deposits in the Postbank must be paid at a rate determined from time to time by the postal company and the Minister in consultation with the Minister of Finance in the case of each kind of deposit.

- Regarding deposits: Deposits in the Postbank made by or for the benefit of, or any National Savings Certificate issued in favour of any person under 21 years of age, may be repaid to that person in the prescribed manner in respect of any particular kind of deposit or account in the Postbank.

- Transfer of deposits from one country to another: The postal company may, in accordance with arrangements made with any postal authority for the transfer from or to the Republic of sums of money standing to the credit of depositors in the Postbank or depositors in a savings bank controlled by that postal authority and subject to this Act.

As an AI, Postbank business is not limited to only reporting obligations but should at a minimum comply with the following:

- Register business as an AI with the FIC in order to ensure regulatory reporting through go-AML;

- Develop a Risk Management and Compliance Programme (RMCP);

- Conduct Customer Due Diligence (CDD);

- Develop a compliance framework and appoint a compliance officer;

- Conduct training on AML/CTPF risks and controls;

- Effectively keep records; and

- Effectively submit regulatory reports to the FIC.

FIC’s website: http://www.fic.gov.za

Based on above activities, we will focus on money remitters and deposits as activities offered by Postbank. Below are money laundering risks which need implementation of controls on

Money Remittances: risks associated with money laundering:

- Money remittances being cash intensive have high risks owing to large values being remitted to high-risk jurisdictions.

- Postbank in this regard, particularly relating to the money remitting activity. It has to ensure that they embed transaction monitoring controls relating to reporting.

- Thus far there have been about 81 964 reports associated Suspicious Transaction and Activity Reports.

Acceptance of deposits and transfers

- Postbank act as a deposit-taking entity without a banking license under a Banking Act exemption.

- Postbank engage in deposit-taking activities under an exemption from being licensed as a bank. Thus they are not supervised for AML/CFT by the SARB:PA, but by the FIC.

- The risks in deposit taking relate to taking cash or any form of money from individuals. It is unable to conduct customer due diligence on.

- Initial findings identified in the Mutual Evaluation Report in the Financial Action Task Force (FATF). Indicate that 34% of cash deposits are done by unknown depositors.

- Rahn consolidated can assist in embedding controls in monitoring cash transactions and reporting accordingly.

ML/TPF Risks Notes: Registration of Postbank as AI

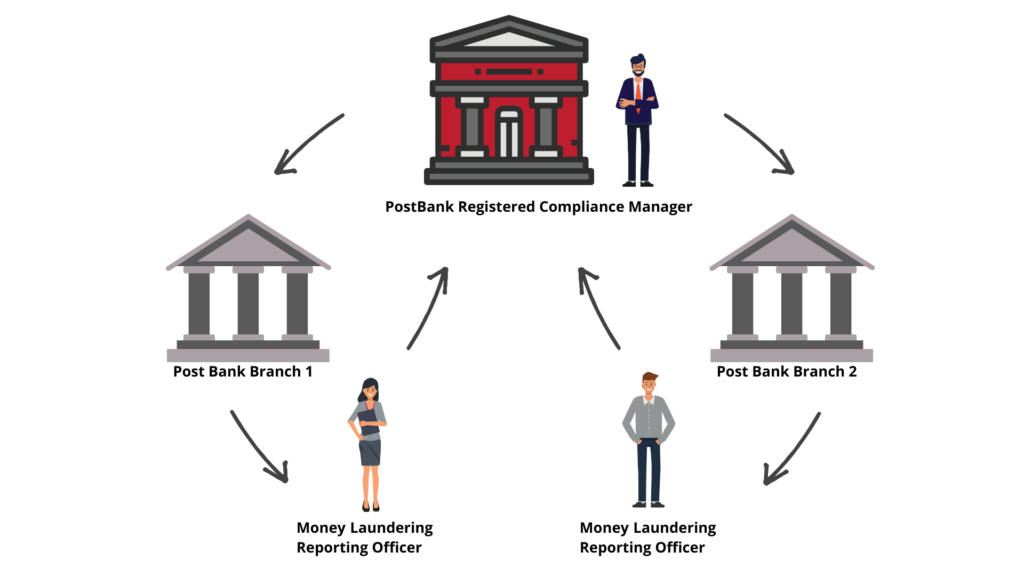

Postbank operating as a Financial Institution would require a registered section 43B compliance officer. And a registered MLRO in its respective branches for purposes of registration.

Ref: PCC05B