Legal Practitioners – RAHN CASE STUDY ISSUE NO.4-2022

Bringing legal practitioners into compliance

An AML/CTPF South African Study

The aim of the Rahn Consolidated articles and case studies are to socialise and acclimatise economic participants on economic crime schemes. The focus will inter alia be on the investigations around legal practitioners, risks, reporting and most importantly its regulatory compliance. The term, economic crime schemes, is often used interchangeably with Financial Crime, and for the purpose of this article both terms will be used interchangeably.

Rahn Consolidated, being at the forefront of deterring Financial Crime through compliance, will focus primarily on the compliance with Financial Crime legislation thus ensuring fines by way of administrative sanctions are mitigated as much as possible.

Issue No.4 deep-dives into legal practitioners as Accountable Institutions (AIs) within the context of schedule 1 of Financial Intelligence Centre Act (FIC Act), as amended. Practitioners who practice as defined in the Attorneys Act are all liable to comply to all requirements and duties of AIs in the FIC Act.

Often, we are of the impression that attorneys or legal practitioners are fully compliant with their entire regulatory universe looking into their areas of expertise. Although every act has a legal opinion, there are exceptionally fine lines between how an act can be interpreted and how section of such an act can be condensed into good compliance.

This article will assist legal practitioners to know what they should comply to as far as Anti-Money Laundering (AML) and Counter-Terrorist and Proliferation Financing (CTPF) is concerned and further highlight the risks of non-compliance thereof.

Enjoy the Read!

The legal industry has diverse business structures which range from small to large practitioners, multi-national firms, and numerous services in different jurisdictions. Compliance by legal practitioners to AML and CTPF risks will therefore not be a one size fits all approach.

It is critical to distinguish the type of legal practitioner and type of service provided thereby, prior to identifying what needs to be complied with. All these should be embedded in the Risk Management and Compliance Programme (RMCP) based on each legal practitioner business structure.

As an AI, legal practitioners should at a minimum comply with the below:

- Register business as an AI with the FIC to ensure regulatory reporting through go-AML (the reporting portal used by the FIC);

- Develop a Risk Management and Compliance Programme (RMCP);

- Conduct Customer Due Diligence (CDD);

- Develop a compliance framework and appoint a compliance officer;

- Conduct training on AML/CTPF risks and controls;

- Effectively keep records; and

- Effectively submit regulatory reports to the FIC.

FIC’s website: http://www.fic.gov.za

Rahn Consolidated’s approach with regards to identifying and mitigating AML and CTPF risks is to embed controls to ensure that legal practitioners’ operations and services are not susceptible to being used in facilitating criminal activities relating to ML/TPF.

At what point do legal practitioners get susceptible to ML/TPF risks?

In each of these designated legal practitioners’ services, there are ways in which money could be laundered, Rahn Consolidated will touch on one of them briefly to gain an understanding of the depth of compliance required in this regard:

- Advising on purchase, sale, leasing, and financing of real property;

- Tax advise;

- Advocacy before courts and tribunals;

- Representing clients in disputes and mediations;

- Advice in relation to divorce and custody proceedings;

- Advice on structuring of transactions;

- Advisory services on regulation and compliance;

- Advisory services relating to insolvency/ bankruptcy;

- Administration of estates and trusts;

- Assisting in the formation of entities and trusts;

- Trusts and company services;

- Legitimising signatures by confirming identity of clients;

- Overseeing the purchase of shares or other participations.

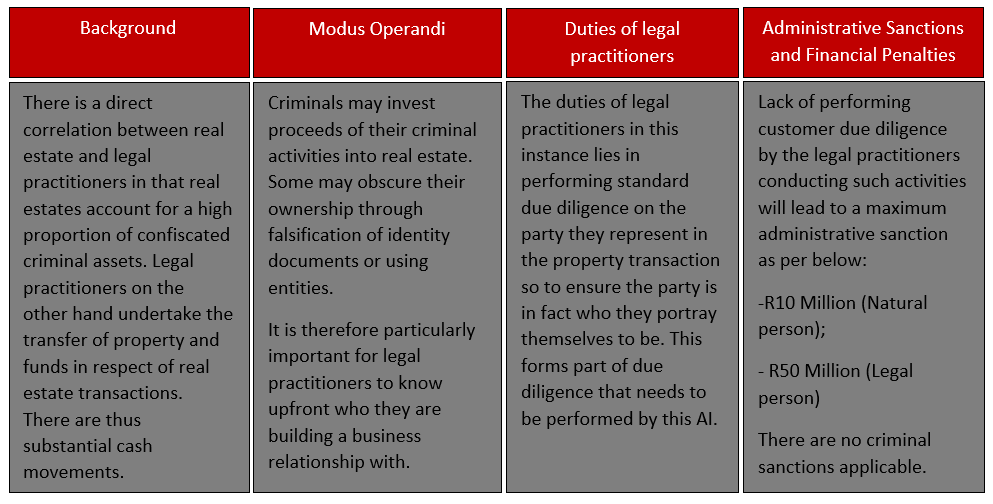

In all these activities, a legal practitioner could be susceptible to ML/TPF risks. Rahn Consolidated has investigated one of the above services to provide a case study to understand the magnitude and relevance of compliance, please refer to the table below. Depending on each activity, requirements may differ with a legal practitioner.

Recent stats on registration and reports received of legal practitioners as Accountable Institutions:

The Financial Intelligence Centre (FIC) has been remarkably successful over the years in driving the registration awareness for all AI, including legal practitioners, which in turn leads to the first step in establishing compliance within this industry.

In the past 2 years, registration has moved from 13 322 to 14 298 which indicates the awareness of legal practitioners who qualify as AIs. However, registration alone does not satisfy compliance.

From a regulatory reporting perspective, legal practitioners have reported the following in the past 2 years:

- Cash Transaction Reports (“CTR” including aggregates “CTRA”): 2505 filed reports

- Suspicious Transaction Report (“STR” including Activities “SAR”): 430 filed reports

Based on the above stats there remain a number of compliance interventions required to steer us to a comfortable level of compliance.

Due to the regulator’s focus on other types of AIs in recent times, there have not yet been any substantial fines issued in the industry. Best practice and country risk assessments have however shown that this industry will be subjected to sanctions and fines soon. Having said that, time is not on our side, the time to comply is now!

Case Study 1: Legal Practitioner advising on purchase and sale of real property