AML Compliance – RAHN CASE STUDY ISSUE NO.2-2022

Financial Crimes Legislative Universe and Financial Penalties

Best Practice and Industry Benchmark

The aim of the Rahn Consolidated articles and case studies series is to socialise and acclimatise economic participants to economic crime schemes. The focus will inter alia be on the investigations around economic crime schemes, risks, reporting and most importantly its regulatory and AML compliance. The term, economic crime schemes, is often used interchangeably with Financial Crime, and for the purpose of this article, both terms will be used interchangeably.

Rahn Consolidated, being at the forefront of deterring Financial Crime through compliance, will focus primarily on compliance with Financial Crime legislation thus ensuring fines by way of administrative sanctions are mitigated as much as possible.

Issue No.2 assists readers in understanding legislative requirements from a financial crime scheme (economic crime schemes perspective). The Authorities/Regulators who are responsible for drafting these legislations seek supervisory assistance from selected supervisors and in turn Supervisors require assistance from compliance officers in all spheres to ensure that legislative requirements are complied with.

From this issue, we will also note in detail the different types of administrative, financial, and criminal sanctions that are available for Regulators and Supervisors to enforce, as a result of failure to adhere to AML compliance.

Enjoy the read!!

AML Compliance – Central to deterring Financial Crime

Issue No.1 has articulated that there is a correlation amongst all financial crime schemes, but most importantly Money Laundering always becomes dominant as it always occurs as a result of predicate offenses such as fraud, cybercrime, etc.

From a country governance perspective, a financial crime such as Money Laundering is governed by the below organisations of which South Africa’s supervisors are members:

• Eastern and Southern Africa Anti-Money Laundering Group (ESAAMLG);

• Financial Action Task Force (FATF); and

• International Money Fund

Money Laundering Supervisory bodies as contemplated in Schedule 2 of the Financial Intelligence Centre (FIC) are as per below:

• Financial Sector Conduct Authority (FSCA);

• South African Reserve Bank (SARB);

• Estate Agency Affairs Board (EAAB);

• National Gambling Regulatory Board for Auditors established in terms of

• Law Society as contemplated in the Attorney’s Act; and

• Provincial licensing authority as defined in the National Gambling Act.

The legislative universe, international standards, and subordinate legislation include but not limited to the below:

- Financial Intelligence Centre Amendment Act

- Guidance Notes (GN);

- Public Compliance Communication (PCC); and

- Directives.

- Protection of constitutional democracies against terrorist and related activities Act (POCDATARA)

- Prevention of Organisation Crime Act (POCA)

- Prevention and combatting of corrupt activities Act (PRECCA)

Rahn Consolidated assists Accountable Institutions (AI) and Reportable Institutions (RI) as contemplated in schedules 1 and 3 of the FIC Amendment Act, by enabling them with regulatory and AML compliance tools based on their relevant regulatory requirements to ensure that they are compliant.

Lack of compliance with the above-mentioned legislation could lead to sanctions that could affect Als and RI. These would in turn adversely have the below effect on AIs and RIs:

• Loss of operating license;

• Administrative fines and penalties; and

• Reputational risks.

One needs to be mindful that the most critical requirement emanating from the FIC amendment Act which assists the FIC’s financial crime investigations is related to reporting suspicious activities to the FIC. Issue 3 will focus primarily on the duties of each AI and RI in embedding financial crime compliance and assisting the FIC to curb Money Laundering risk.

AML Compliance – Financial Crimes Legislative Universe and Financial Penalties

Best Practice and Industry Benchmark

In this Issue, Rahn Consolidated will highlight the Regulatory Universe (legislation), particularly pertaining to Money Laundering and other predicate offences to form a baseline for its readers in order to be guided as to how to navigate the financial crime regime.

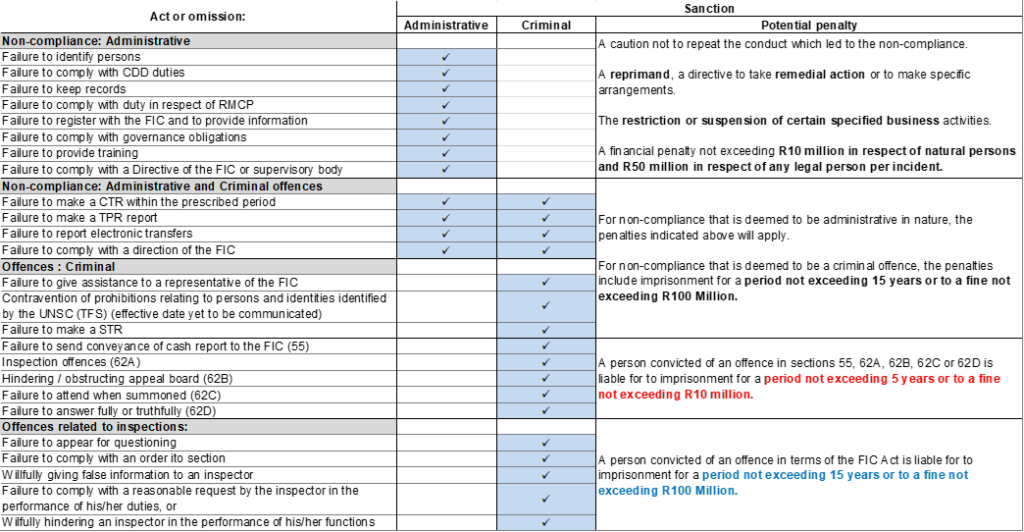

Fines and Penalties that are enforced by the Financial Intelligence Centre are depicted in the below table. AIs and RI should take into account the fact that as a form of managing risks (AML risks and non-compliance) and therefore implementing an adequate risk response sufficient to the AI/RIs risk appetite, one should ensure that they invest in mitigating these risks.

“If you think compliance is expensive- try non-compliance”

Former U.S. Deputy Attorney General Paul McNutty

It has become common practice for most organisations, as a form of risk response, to prefer to accept the risks of not conforming to AML compliance and instead budget for fines. Although organisations may accept this, reputational risks to organisations have more dire effects than those administrative sanctions.

The difference between administrative, financial, and criminal sanctions are best described below: