Economic Crime Schemes – RAHN CASE STUDY ISSUE NO.1-2022

Financial Crimes Governance Documents Introduction to Financial/ Economic Crime Schemes-SA and Internationally Focused Studies

The aim of the Rahn Consolidated articles and case studies is to socialise and acclimatise economic participants to economic crime schemes. The focus will inter alia be on the investigations around economic crime schemes, risks, reporting, and most importantly its regulatory compliance. The term, economic crime schemes, is often used interchangeably with Financial Crime, and for the purpose of this article, both terms will be used interchangeably.

Rahn Consolidated, being at the forefront of deterring Financial Crime through compliance, will focus primarily on compliance with Financial Crime legislation thus ensuring fines by way of administrative sanctions are mitigated as much as possible.

Issue No.1 assists readers from all spheres to understand the basics thereof before we deep dive into its main components.

Enjoy the read!!

Economic Crime Schemes also referred to as Financial Crimes range from different types of “schemes” inter alia:

- Fraud;

- Terrorist Financing;

- Bribery and Corruption;

- Cybercrime;

- Market abuse and insider dealing;

- Information Security;

- Proliferation Financing; and

- Money Laundering.

In most instances, Money Laundering is a type of scheme used as a predicate offense to the above-mentioned crimes. This implies that these crime schemes do not and will not be executed in isolation. Most of them ultimately lead to proceeds of these crimes being laundered using mostly financial institutions. What the Financial Intelligence Centre (“FIC”) refers to as Accountable and Reportable Institutions. These will be deed-dives in the more articles to be provided by Rahn Consolidated.

Financial Crime Schemes (Economic Schemes)

South African and Internationally Focused Studies

Different types of schemes have their own modus operandi in that, each scheme has a targeted audience (victims) and enabler (technology) it uses. For instance, looking into Money Laundering as a financial crime scheme, the modus operandi of the perpetrators is to “wash-up” elicit money (called layering) and ensure that it is used back in the economy as clean money (integration). The modus operandi for Fraud for instance is based on the perpetrator being deceitful, dishonest, misleading, and having irregular acts with an intention to benefit illicitly.

With data being very prominent these days, perpetrators have also found ways through using different types of schemes to ensure utilise the current currency “data” in order to make their operations successful. Focusing on Cyber Crime as a form of financial crime indicates to us that perpetrators cannot function without obtaining

data from victims to successfully conduct their business operations. Rahn Consolidated has specialists that deal with data on a daily basis. In fact, from a best practice perspective, Rahn has found that inadequate or lack of accurate data is much more prone to administrative sanctions by the Regulator than having data that is simply not utilised.

Rahn’s next issue will also focus on administrative sanctions that were imposed from a regulatory perspective. To provide a glimpse of the correlation between data, administrative sanctions, and financial crime, the below illustrates a couple of cases in which fraud is still prominent as a financial crime scheme. This particular scheme also vastly affects data and information exchange.

Each Financial Crime Scheme in turn has its own regulatory landscape which assists the Regulators/ Authorities and Supervisors in combating these criminal schemes. The financial industry has an extended control measure of appointing compliance officers to ensure that risks pertaining to schemes are mitigated based on the business’s risk appetite. The control measure implemented in this regard is what is referred to as Financial Crime Compliance (FCC).

FCC’s primary tool is the regulations that each country imposes on its industries based on different business trades. That is to say, there are different regulations that the Regulators/ Authorities impose on Financial Service Providers, Banks, Credit Providers, Estate Agents, and car dealers to name a few. Rahn’s next article issue will focus primarily

“ Keeping your Institution on the right side of Regulators requires keeping your Financial Crime Compliance (FCC) knowledge and Teams in tandem with an evolving AML industry”

Shawki Ahwash

on these particular legislations including primary and legislative regulations. At a minimum, FCC aims to study each business activity, identify risk areas that may make the business susceptible to Financial Crime then continue to mitigate those risks by assisting businesses to implement financial crime control measures.

Fraud and financial crimes are on the rise

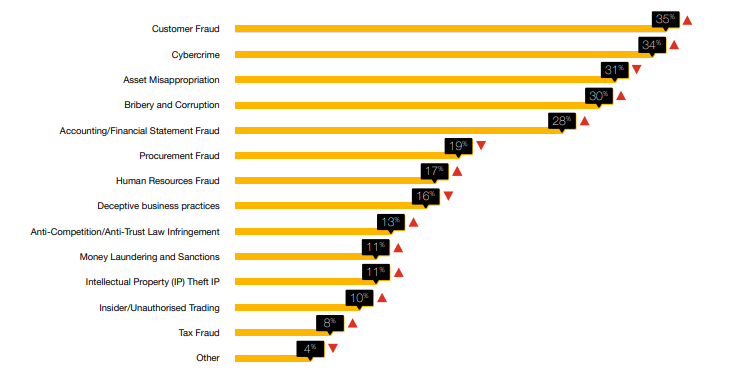

Source: PWC 2020 Global Economic Crime and Fraud Survey

Financial Crime perpetrators have evolved immensely over the years and have largely affected the financial industry. Not only has Financial Crime Compliance been at the forefront of assisting Regulators/Authorities to curb this. They have been made aware of the different types of financial schemes around them on a daily basis.

The current technology enablers often make it very easy to penetrate the market. They make use of those businesses that do not have adequate controls to mitigate these risks (“scheme”).

As part of daily activities, Rahn Consolidated offers inter alia:

- Clean up of data to ensure that it is complete and accurate;

- Systems that will connect the interrelatedness of financial crime between different clients; and

- Compliance with regards to data taking into account all regulatory landscapes.

Most Financial sanctions emanating from money laundering as a form of financial crime scheme emanate from regulatory reporting which is a result of a lack of data. Just to name a few, Clientele Life Assurance Company Limited is but one of the recent Financial Service Providers and Accountable Institution that was sanctioned R200 000 for not complying with the reporting requirements which leads to inadequate data. This might not be material however it is likely to have an adverse reputation for the company.